Copper fell below $8,000 a tonne for the first time in nearly 18 months on Friday as mounting fears of a recession weigh on the world’s most important industrial metal.

Widely regarded as a gauge of economic activity because of its use in everything from home appliances to electric vehicles, the metal fell a whopping 3 percent to $7,959 per ton, holding it on track for its fourth consecutive weekly decline.

Other metals also closed the third quarter dismal, with nickel down 3 percent and aluminum down 2 percent, despite data showing an increase in manufacturing activity in China, the world’s largest consumer of raw materials.

“This suggests that the market does not find the improvement enough to offset the potential slowdown in advanced economies,” ANZ strategists said in a report.

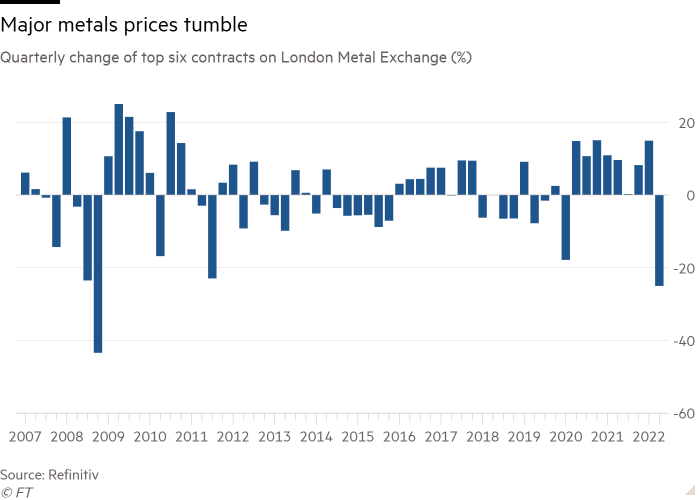

Fears that demand will be curtailed as central banks quickly raise interest rates to curb inflation and thereby slow economic growth saw the London Metal Exchange’s six major contracts in their worst quarter since the global financial crisis from April to June. crisis in 2008 register.

That was a marked change from conditions earlier in the year when copper traded at a record over $10,600 a tonne due to supply disruptions and booming demand as lockdown restrictions eased.

Before and during that period, many generalist investors bought copper, believing that prices would be supported by a lack of new supply projects in the pipeline and rising demand from the electric vehicle industry as well as from the makers of wind turbines and solar panels.

While that story is still expected to come true — albeit later in the decade — the prospect of a hard economic landing in the US and Europe is scaring investors.

In a report, Marex, a major commodities brokerage, said “money flows” were the main factor driving losses in the industrial metal landscape. That view was shared by analysts.

“It’s a sell-off by macro funds,” said Tom Price, Liberum’s head of commodities strategy. “We’re seeing a similar drop in energy, metals and gold, falling below $1,800 an ounce. It’s across the board. People get money from the sector.”

Despite the storm clouds gathering over the global economy, Colin Hamilton, commodities analyst at BMO Capital Markets, said copper market fundamentals were still sound, with the latest industry research indicating end-user demand in developed markets remains robust for now.

Price agreed: “If I just look at trade flows, especially China, consumption rates, premium signals, inventory levels, I’d say this looks like a tight, balanced market. But that’s not what the price tells you.”

Copper bulls are now pinning hopes on China and a pick-up in demand as Covid-19 cases ease and policymakers try to boost economies through stimulus packages.

“There is always hope that China will save the world through a massive infrastructure stimulus package,” said Jean-Sébastien Jacques, former CEO of Rio Tinto on LinkedIn. †

“It’s happened a few times in the past, but is hope a strategy? No should be the answer. In any case, the timing of such a stimulus package is highly uncertain and would likely require a material debt increase at the local or state level.”