The IMF has said there is a growing risk that the global economy will slide into recession next year as households and businesses in most countries face “stormy waters”.

China’s zero-covid policy and fragile housing market, the need to raise interest rates to contain inflation in advanced economies, and higher energy and food prices after Russia’s invasion of Ukraine will reduce global economic growth from 3.2 percent in 2022 to 2.7 percent next year, the fund predicted.

The growth forecast for 2023 is the lowest for the coming year the IMF has published since 2001, excluding the years of the coronavirus pandemic and following the global financial crisis.

The fund’s economists believed there was an even greater chance that the global economy would underperform the central forecast and a 25 percent chance that growth would fall below 2 percent. That would represent the global economic weakness seen only one in ten years and only in 1973, 1981, 1982, 2009, and 2020 over the past half century.

In an interview with the Financial Times, Pierre Olivier Gourinchas, chief economist at the IMF, said there was a whopping 15 percent chance that global growth would eventually fall below 1 percent. This level would likely hit the threshold of a recession and would be “very, very painful for a lot of people”.

“We’re not in a crisis yet, but things really don’t look good,” he said, adding that 2023 would be the “darkest hour” for the global economy.

Financial turmoil, triggered by a shift to dollar-denominated assets, threatened to amplify the economic threat.

“As the global economy heads into stormy waters, financial turmoil may break out, prompting investors to seek the protection of safe-haven investments such as US Treasuries and push the dollar even further,” Gourinchas added in his statement accompanying went off the report.

While sharp increases in interest rates around the world weighed on growth, the IMF said they were needed to help bring inflation back under control and stabilize the global economy.

The fund forecasts inflation in advanced economies to reach 7.2 percent this year and 4.4 percent next year, both more than 1 percentage point higher than previous April 2023 forecasts. consumer prices will peak at an annual rate of nearly 10 percent this year, before moderating to 8.1 percent by 2023.

“On the front line you have the central banks. That’s their job, that’s their mandate [and] their whole reputation is at stake,” said Gourinchas. The fund said monetary authorities should “stay on track” rather than repeat the mistakes of the 1970s, when most monetary policymakers didn’t have the guts to keep raising interest rates when their economies slowed or stalled.

The IMF admitted there was a chance to tighten monetary policy too far, but said the risks of overdoing it weren’t as serious as normalizing inflation and letting it become ingrained in everyday life.

For the US Federal Reserve in particular, Gourinchas warned that it was too early to pull out of its aggressive campaign to tighten monetary policy.

“We’re a long way from winning that battle,” the chief economist said, adding that any signal that the Fed would not raise rates further could be interpreted by financial markets at this point as a sign that policymakers were unwilling “to do what it takes”.

“Inflation expectations could anchor and we could have a more persistent process,” he said.

Continuing its recent criticism of the UK’s economic policy, the IMF advised all countries not to pursue very expansionary policies on taxes and government spending, despite soaring energy and food prices.

It was necessary to reduce deficits and rebuild fiscal buffers, Gourinchas said. “Doing otherwise will only prolong the struggle to bring inflation down, risk negating inflation expectations, raise borrowing costs and fuel further financial instability, which leaves the task of fiscal, monetary and financial authorities alike. complicates, as recent events illustrated,” he said. said in his statement.

Recommended

Gourinchas compared it to two drivers, each with their own steering wheel, and told the FT that opposing fiscal and monetary policies prompted financial markets to wonder, “Which way is that car going? Are we really fighting inflation or are we really stimulating it?” economic activity?”

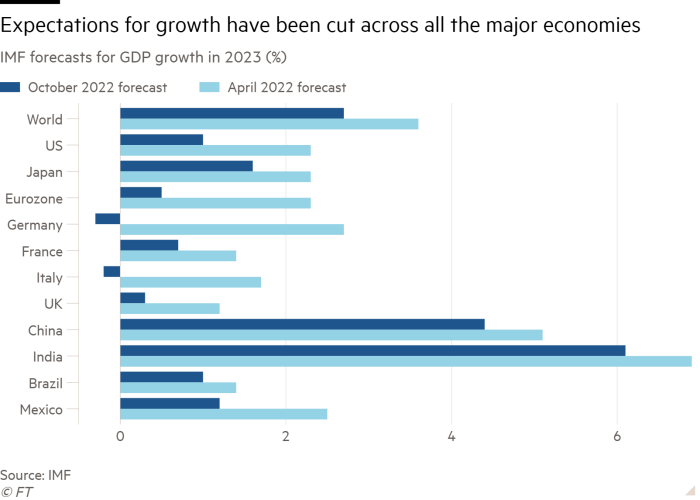

In the revised forecasts, 93 percent of countries received a cut in their growth forecasts.

The global growth forecast for 2022 has fallen from 4.9 percent in the fund’s report a year ago to 3.2 percent today. The growth forecast for 2023 was cut from 3.6 percent a year ago to 2.3 percent, with cuts concentrated in advanced economies rather than the emerging world.

In what will be a difficult report for the Beijing government as it prepares for the 20th National Congress of the Communist Party, China’s economy was forecast to grow only 4.4 percent this year, well below the government’s growth target of 5.5 percent. The IMF expects this annual growth rate to only improve to 4.6 percent over the next five years.

The U.S. economy is expected to stagnate in the four quarters of 2022 and then maintain sluggish growth of 1 percent in 2023. Many European countries will slide into recession, the IMF predicted, as households and businesses struggle to keep up with natural gas prices. times 2021 levels.

The fund was not more optimistic about the future. The reductions would likely be permanent, it said. Scars from the pandemic and war in Ukraine would make the global economy 4.3 percent smaller in 2024 than expected in January 2020 as the coronavirus began to spread worldwide.