In Eric Farmelant’s nearly decade-long career as a real estate agent in Miami, he had never witnessed renters waging wars over rental properties until the coronavirus pandemic fueled the burning demand for beachfront housing in Florida. He can no longer show four or five advertisements to customers because many of the properties are rented out unseen.

“You see tenants put down a year’s rent in advance to get their offer accepted,” says Farmelant, who works for Ibis Realty Group.

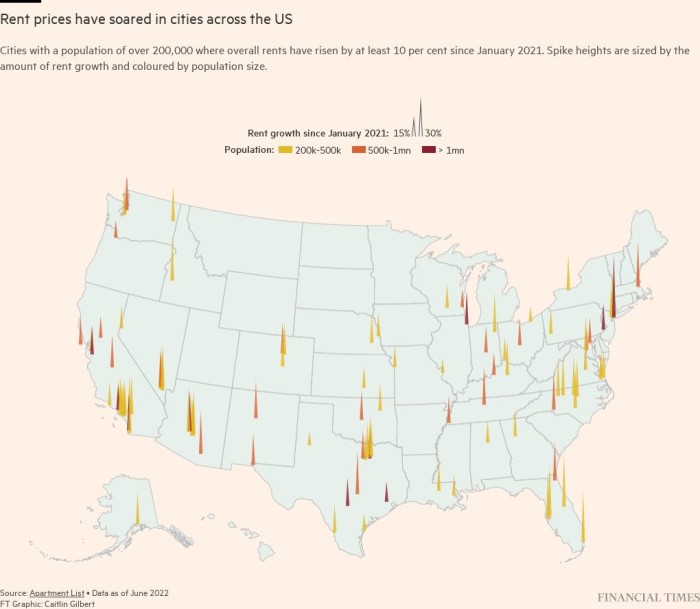

Rents, in turn, have risen nearly 40 percent since January 2021, according to Apartment List, pointing to a broader trend gripping the country.

For real estate agents, double-digit rent increases are a boon to business. For the Federal Reserve, they are yet another hurdle in the central bank’s quest to control its worst inflation problem in decades.

While little relief is expected in the near term, economists warn that higher rents will accelerate and maintain upward pressure on inflation even as consumer price growth for other categories stagnates. It makes the US central bank’s task of dealing with rising prices all the more difficult.

“It’s going to be hard to say ‘we have inflation under control’ if the cost of housing continues to rise,” said Sarah House, senior economist at Wells Fargo. She expects high rental inflation to persist through at least the end of the year, and despite some compensating moderation in other goods and services, “that will complicate the task ahead of the Fed.”

Top officials pay close attention to housing inflation, as it is such an important component of headline inflation.

By some estimates, the cost of lodging makes up about one-third of the consumer price index, which rose at an annual rate of 9.1 percent in June, according to the Bureau of Labor Statistics, which was the fastest increase since November 1981. core” measure, which excludes volatile items like food and energy, makes up more than 40 percent.

Compared to the same time last year, rents rose 5.8 percent after the largest monthly increase since 1986 of 0.8 percent. Owners’ equivalent rent, a measure of what homeowners think their properties would rent, rose 0.7 percent. Overall, the cost of lodging has increased by 5.6 percent in the past 12 months, the most since 1991.

The faster-than-predicted acceleration has adjusted expectations about how quickly headline inflation could moderate this year and how much more monetary policy tightening is on the way. The Fed has said it needs to see a marked slowdown in monthly inflation data before significantly slowing down the rate at which it raises interest rates.

Rental inflation forecasts depend largely on the trajectory of house prices, which surged during the pandemic as people rearranged their lives into a new era of working from home, seeking less densely populated locations and taking advantage of ultra-low mortgage rates. As more potential buyers were priced out of the market, they turned to rental options.

Now buyers are being priced out for another reason. House prices are starting to moderate after hitting a new record high in June, according to data released by the National Association of Real Estate Agents on Wednesday. But the cost of financing that purchase through loans has skyrocketed now that the Fed has raised interest rates.

According to Realtor.com, the gap between the monthly cost of ownership of a starter home and rents has widened by about 25 percentage points, or nearly $500. In June alone, the NAR reported that sales of previously owned homes were down 5.4 percent, or 14 percent from a year earlier.

“People who have been priced out of the owner-occupied housing market are increasingly turning to the rental market and that is also driving demand,” said Daryl Fairweather, chief economist at Redfin.

Coupled with the fact that rents track changes in house prices by about 18 months, Kathy Bostjancic, chief US economist at Oxford Economics, said rental inflation may not decline until the second quarter of 2023.

Economists like Ryan Wang of HSBC have revised their forecasts upwards, pushing annual rental inflation above 7 percent early next year.

“New leases are being entered into at much higher rent levels than before, leading to increases in the overall universe of rents as measured by the CPI,” he said.

Given the way BLS calculates rental data, it may also take a while for broader inflation effects to show up in the official numbers. Michael Pond, head of global inflation-related research at Barclays, estimates the delay could be anywhere from six to nine months.

In February, researchers at the Fed’s San Francisco branch estimated that current trends in the rental market would increase overall CPI inflation by an additional 1.1 percentage points in both 2022 and 2023, or 0.5 percentage points relative to the central bank’s preferred inflation gauge, the index of personal consumption expenditure. So far, those predictions have come true.

What could alleviate some of this pressure is increased housing supply, which the Biden administration is prioritizing. But economists and housing experts say those efforts are doing little to alleviate the immediate problem.

“We don’t have enough homes. Even if you build more than half a million units,” says Danushka Nanayakkara-Skillington of the National Association of Home Builders. Rising material costs for builders are also being passed on to tenants, she said.

Recommended

Brokers and real estate investors are most wary of a recession, economists are forecasting next year as the Fed goes through its “unconditional” commitment to restore price stability. For Tom Porcelli, an economist at RBC Capital Markets, housing is probably already “just at the beginning of a recession”.

“We expect a period of stagnant economic growth due to the Fed rate hikes,” added Redfin’s Fairweather.

“That will drive down price growth for pretty much everything, including rent. But it will be a while before that seeps through.”